Why IT Due Diligence is Important in PE Investments

IT due diligence often seen as a low priority when private equity firms perform due diligence on a company. In the world of the technology rapidly evolving the significance of IT due diligence cannot be overstated. As technology becomes the core of the business, understanding the technological landscape of a potential investment becomes crucial. This is not just about assessing the current state of IT but about understanding its potential impact on the value, risk, and future growth of the company. The quality and innovativeness of the company, its team and application can ultimately determine the scalability, longevity, and sale ability of a company.

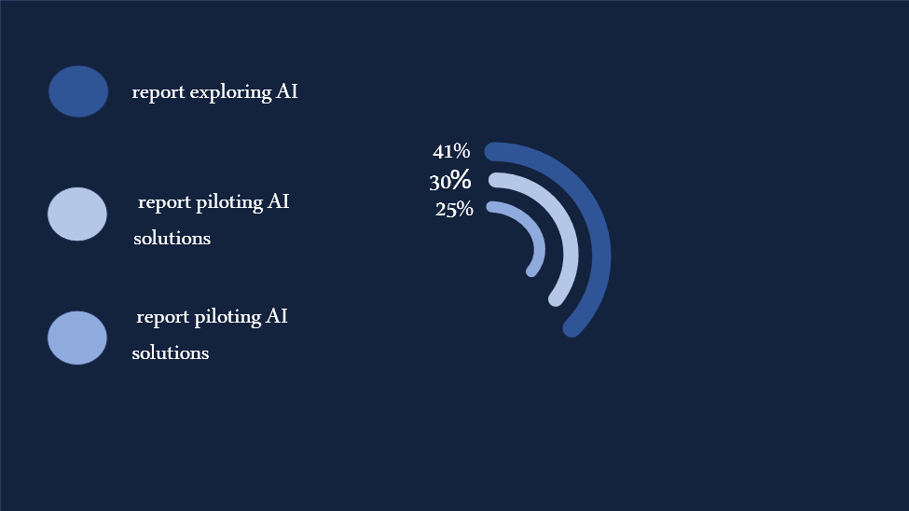

Technological advancement has triggered major changes across the mid-market landscape. In the current competitive market, being able to understand and evaluate technological risks and values become critical.

[1] 2023 Mid-market technology trends report, Deloitte, 2023

Some of the key drivers of change are:

- Shift to Cloud-Based Solutions: The move towards Software as a Service (SaaS) and cloud-based architectures is reshaping how businesses operate, offering flexibility and scalability. It the same time, IT budget is moving from more capital expenditures (CapEx) towards operating expenditures (OpEx).

- Rise in Cyber Crime: The increasing number of cyberattacks, especially against mid-market companies, underscores the importance of robust cybersecurity measures. All cybercrime comes at a high cost to businesses – in the Canada, ransomware remediation on average costed for companies $2 million.1

- Adoption of Disruptive Technologies: Technologies like artificial intelligence, blockchain, and augmented reality, are redefining competitive boundaries of the mid-market players and not only. Companies investing in edge of technology to win the competition. Understanding an IT footprint of the company today helps private equity firms to evaluate what it will take to be competitive tomorrow.

- Talent Gap: The rapid pace of technological change means that businesses often face challenges in finding and retaining the right IT talent. With a such advancement in the technology space, finding and retaining IT talent become a significant challenge for companies.

Risks of Not Performing IT Due Diligence Facing Private Equity Firms

Evaluating company’s technological current value and future potential has never been important than now. This requires private equity firms to have an IT seat during the due diligence process to identify and assess technological risks.

We have identified three key risks for the private equity sector that IT due diligence can address:

Inheriting Technology Debt

Technical debt, which refers to the costs associated with outdated or inefficient technology, can significantly impact a company's valuation. If not identified during due diligence, PE firms might inherit a substantial amount of hidden costs related to technology modernization. On average 10-20% of the IT budget spent to update the tech stack of the company. But if it’s not properly evaluated, these numbers can easily double up and can reduce deal value significantly or require new investment after the deal.

Misalignment of IT and Business Strategy

A misalignment between IT and business strategy can lead to multiple risks such as inefficiencies, wasted resources, and missed opportunities. This may happen due to talent gaps and a mismatch of processes in the company. Poor technology integration, abandoned systems, or improperly designed databases can add up unnecessary operational cost to increase speed of the systems. All this can increase a company’s technology debt, which may require significant investment in the future.

Increasing of Cybersecurity Posture

In today's digital age, cybersecurity is paramount. A lapse in cybersecurity measures can expose businesses to significant risks, from data breaches to financial losses. It's essential for PE firms to assess the cybersecurity posture of their potential investments. A big part of cybersecurity risks related to the technology, it’s important to evaluate target company’s cybersecurity controls and its external suppliers’ security.

If a company spends significant of time and resources to manage tech debt, realigning IT strategy and dealing with cybersecurity incidents, it has less time to invest in forward looking technology strategies and investments that support company’s growth.

Poor IT due diligence will require more time for solving the problems and investment to improve technological debt.

Consideration for Value Creation in Private Equity

For private equity firms, the goal is not just to identify risks but also to uncover opportunities for value creation. By understanding the IT landscape of a potential investment, private equity firms can:

- Leverage IT as a Value Driver: By viewing IT not just as a cost center but as a strategic asset, PE firms can drive operational efficiencies and open up new revenue streams.

- Optimize IT Infrastructure: Whether it's migrating to the cloud or adopting advanced security measures, optimizing IT infrastructure can lead to significant cost savings and performance improvements.

- Harness Data Analytics: In the age of big data, analytics can offer invaluable insights, driving better decision-making and uncovering new opportunities.

- Strategic IT Investments: By identifying areas where strategic IT investments can lead to significant returns, PE firms can ensure that their investments are poised for growth.

In conclusion, IT due diligence is not just a box to be ticked in the PE investment process. It's a critical component that can determine the success or failure of an investment. By understanding the technological strengths and weaknesses of a potential investment, PE firms can make informed decisions that drive value creation.

How PKF Antares can help

Our industry professionals with decades of cumulative knowledge, PKF Antares offers a broad range of services that can help private equity firms navigate business, financial, and technological risks before and after acquisition.

1 Cyber Crime Statistics for Canadians, Made in Canada, August 11, 2023