The Ever-Changing Role of the CFO

How the Responsibilities of the CFOs are Evolving

In this dynamic and rapidly changing business landscape, where products are transitioning to services, direct customer outreach is the norm, and expectations are soaring, businesses are undergoing a continuous transformation fueled by data and digital interactions.

The CFO has become a key player in this big shift to digital. Traditionally tasked with safeguarding critical assets and fulfilling core financial responsibilities, the role has evolved into a significantly more intricate and multifaceted position.

Nowadays, the CFO does more than just “handling the budget”. They play a key role in carrying out company plans and overseeing changes, by wisely distributing resources and skillfully managing projects. As a central figure in the executive team, the CFO works closely with various business departments such as IT, sales, and marketing.

In the contemporary business landscape, executives and stakeholders rely heavily on CFOs to be proactive and value-enhancing collaborators. These CFOs are essential in providing guidance on optimization by utilizing both financial and non-financial data for effective decision-making. As the business environment becomes increasingly intricate and interconnected, CFOs are mandated to possess a distinctive skill set that goes beyond traditional financial knowledge.

This expanded skill set includes expertise in propelling digital transformation, evaluating risks associated with environmental, social, and governance (ESG) factors, and navigating extensive data landscapes. Amid these challenges, CFOs maintain a keen focus on achieving financial objectives, solidifying their position as key drivers of success in the dynamic world of modern business.

Several factors have combined to modify the opportunities and expectations for CFOs.

1. Technology

The evolving responsibilities of the CFO, extending beyond traditional financial boundaries, necessitate reliance on technology. Utilizing digital tools, ranging from analytics to artificial intelligence, empowers the CFO to enhance operational efficiency and extract valuable insights, facilitating optimal decision-making for the company.

According to a 2022 Gartner survey, 82% of Chief Financial Officers (CFOs) reported that their financial commitments to digital initiatives are increasing at a faster rate than their investments in talent, supply chain, business services, or fixed assets.

Speeding up the process of digital transformation has the potential to improve efficiency and productivity. However, it has also introduced a new challenge for the finance sector to stay up to date. As finance adopts digital tools, there is a heightened demand for staying current and adapting to technological changes.

Tim Zue the Red Sox’s CFO Said: We embrace technology and automation on the business side of things. Our finance operations, especially tasks surrounding interoffice duties like processing invoices, have greatly improved over the years thanks to the technology we’ve invested in.

2. Globalization

As businesses embrace globalization, they encounter increasingly intricate challenges. Consequently, the role of the Chief Financial Officer in numerous companies is evolving, emphasizing the success of global initiatives. In the near future, considering the pivotal role of global expansion in organizational strategies, CFOs might also be referred to as the chief frontier officer.

3. Evolving Expectations

The CFO's role is evolving due to various factors. Paul Young, CPA, CGMA, senior executive vice president and CFO at Liberty Bank of Middletown, Conn. views CFOs as chief future officers, emphasizing the need for real-time business awareness and foresight to anticipate future scenarios. For instance, in a bank, factors like the Federal Reserve's actions affecting the net interest margin require quick forecasting and scenario planning with advanced technology. CFOs are now expected to offer capabilities beyond foresight, such as collaboration, understanding the business, and serving as change agents and storytellers. Being a trusted adviser allows CFOs to question the status quo, present data, and contribute to decision-making at the leadership table.

4. Rapid change

Being agile is crucial because businesses constantly face new threats. The fast pace of change makes companies move quickly, but it also brings new and bigger risks like cybersecurity issues, data privacy concerns, shareholder activism, international conflicts, and a messy political environment. Additionally, technology is advancing rapidly, outpacing the systems we have in place. The key is to keep essential skills intact while pushing for progress.

5. Expanding role of finance

Finance is also taking a range of new functions under its oversight. The role of CFO is no longer confined to conventional tasks such as accounting, finance, and treasury; it now involves a greater focus on digital functions. Additionally, finance is set to play a significant part in addressing environmental, social, and governance (ESG) considerations, given the various ESG reporting frameworks already in place and continuous endeavors to improve disclosure. The distinctive position of finance makes it well-suited to assume a leadership role in these developments.

6. The Requirement for New Skill

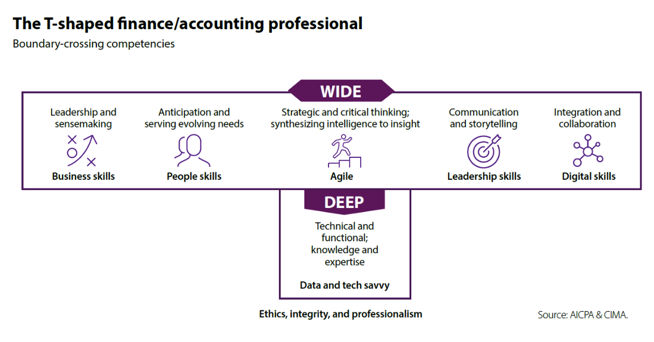

The era of spending decades working in a single company in a consistent role with unchanging skills has long become a thing of the past. According to Tom Hood, CPA/CITP, CGMA, executive vice president–Business Growth & Engagement at AICPA & CIMA, the contemporary CFO should embody the characteristics of a T-shaped professional. This individual possesses a blend of business acumen, interpersonal skills, leadership qualities, and digital proficiency. Additionally, they exhibit agile strategic thinking and critical reasoning, enabling them to navigate diverse situations effectively (see the chart below). Moreover, this professional boasts in-depth technical and functional expertise, rooted in ethical principles, integrity, and professionalism.

In conclusion, the role of the CFO has evolved significantly in response to dynamic business changes. Modern CFOs, beyond traditional financial duties, now drive digital transformation, navigate global challenges, and address expanding responsibilities in ESG considerations. Technology plays a crucial role, with CFOs relying on digital tools to enhance efficiency and make informed decisions. The CFO is becoming a chief frontier officer in global initiatives.

Expectations have shifted, requiring CFOs to be chief future officers with real-time awareness and change-agent abilities. Agility is essential amid rapid business changes and emerging risks like cybersecurity. The contemporary CFO embodies a T-shaped professional, combining business acumen, leadership, interpersonal skills, and digital proficiency, rooted in ethical principles. In essence, the ever-changing CFO role reflects a strategic position, contributing significantly to overall business success in today's dynamic landscape.